givily benefits

We are excited to welcome our newest vendor partner Givily! Givily is a web-based donation request management tool.

GIVILY IS a tool that helps streamline and track all the donation requests you receive from your communities.

- Track and understand your charitable giving

- Measure your impact and report on it

GIVILY ELIMINATES 60% of the current time invested in managing donation requests.

- Requests coming in from several places

- Incomplete data to make a decision

- Scattershot giving

- Inability to track impact of your corporate giving

GIVILY HELPS

- Streamline and save time managing donation requests

- Track and understand your charitable giving

- Uncover the best giving opportunities

- Maximize brand recognition

- Provide impact reporting that can be used by PR/marketing

GIVILY PROVIDES

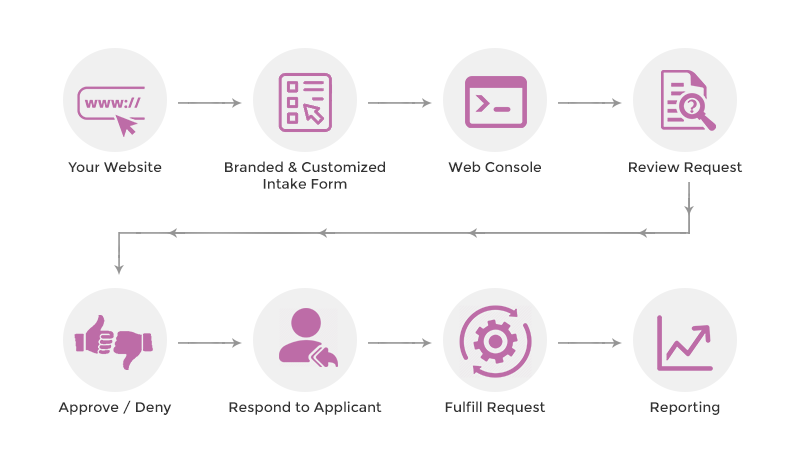

- A branded and customized application form on your website & a cloud-based management platform

- Full Account Setup & Launch

- Coaching to members who want to increase their strategic community engagement

- Discounted rates as part of your membership

To contact Givily and begin the process of learning how their donation management tool can improve your winery’s experience, use the contact form linked below:

- CONTACT GIVILY FOR MORE INFO -

Member Login

Member Login